Navigating the Current Mortgage Landscape in Korea

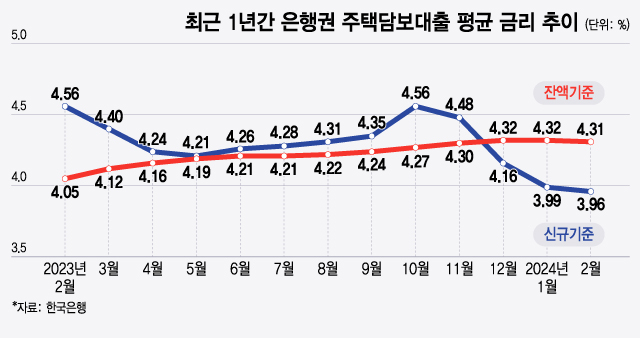

The Korean housing market is currently facing a unique challenge: rising interest rates amidst a strong desire for homeownership. While interest rates were initially expected to decline this year, they have instead taken an upward trajectory due to global economic factors, particularly inflation concerns. This poses a dilemma for potential homeowners, as higher interest rates translate to increased monthly mortgage payments and overall financing costs.

Despite these challenges, purchasing a home remains a significant life goal for many Koreans. With careful planning and strategic approaches, you can still secure a mortgage with favorable terms and minimize the impact of rising interest rates. Here are some key strategies to consider:

1. Comprehensive Comparison of Financial Institutions:

The first crucial step is to meticulously compare mortgage offerings from various financial institutions. Each institution has its own set of criteria for determining interest rates, which can vary significantly. Utilize online financial comparison platforms like Finda, Bankmall, and others to gather information and identify the most competitive rates.

Importantly, recognize that interest rates can fluctuate even within the same day. Therefore, it’s highly recommended to seek professional advice from a qualified mortgage broker or financial expert. Their expertise can help you navigate the complexities of the market and secure the best possible deal aligned with your specific circumstances.

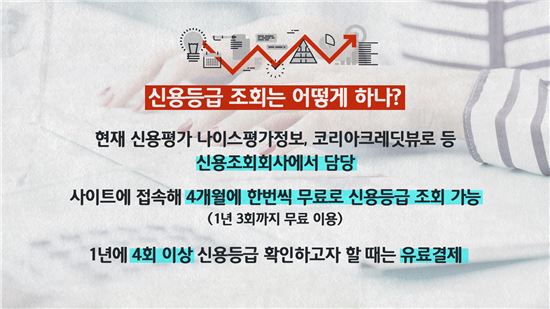

2. Enhancing Your Credit Score:

Your credit score plays a pivotal role in determining your mortgage interest rate. A higher credit score indicates a lower risk of default, making you more attractive to lenders and qualifying you for lower interest rates. Prioritize good credit management practices by consistently repaying loans, maintaining a low credit card utilization ratio, and avoiding late payments.

3. Selecting a Product Tailored to Your Needs:

Carefully consider your financial profile, including income, assets, and collateral type, when choosing a mortgage product. For instance, if you have a high income or substantial assets, you may benefit from preferential interest rates offered by certain institutions. Explore various product options and select the one that best suits your financial situation and goals.

4. Capitalizing on Interest Rate Reduction Benefits:

Several financial institutions offer interest rate reduction benefits to specific customer segments, such as new borrowers, high credit score holders, or those with a proven track record of loan repayment. Actively seek out and utilize these benefits to lower your overall interest rate.

5. Considering Variable-Rate Mortgages:

Variable-rate mortgages can be an attractive option if you anticipate future interest rate declines. However, exercise caution and carefully assess your risk tolerance, as rising interest rates could lead to higher monthly payments.

Additional Tips for Navigating the Current Market:

- Long-Term Perspective: While interest rates may fluctuate in the short term, consider the overall affordability of your mortgage over its entire duration, typically 25 years.

- Market Insights: Stay informed about economic trends and interest rate forecasts to make informed decisions about your mortgage strategy.

- Professional Guidance: Seek guidance from experienced mortgage brokers or financial advisors who can provide personalized recommendations and help you navigate the complexities of the market.

Conclusion:

Purchasing a home in Korea’s current economic climate requires careful planning, informed decision-making, and a strategic approach to securing the best possible mortgage terms. By implementing the strategies outlined above, you can increase your chances of securing a mortgage with a favorable interest rate and achieving your dream of homeownership.

Remember, buying a home is a significant investment, and it’s crucial to make informed choices that align with your long-term financial goals.

I hope this information is helpful! Please let me know if you have any other questions.

댓글 남기기