Today, I want to delve into a topic that’s near and dear to many of us: real estate valuation. Whether you’re a seasoned investor or simply considering buying your first home, understanding how property values are determined is crucial.

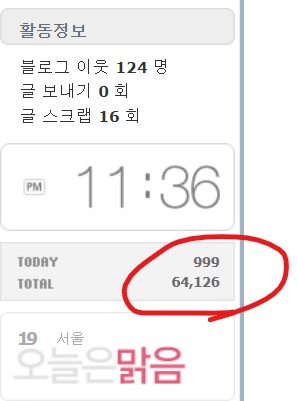

Anyway, I’m thrilled to announce that my blog has reached a significant milestone: 1,000 visitors! It’s been a journey filled with hard work and dedication, and I’m grateful for each and every one of you who has taken the time to read my posts.

Accurately assessing the value of a property is a complex task that involves numerous factors. In Germany, there are primarily four methods used for real estate valuation:

The Complexity of Real Estate Valuation

- Comparative Method (Vergleichsverfahren):

- How it works: This is the most common approach, involving comparing the subject property to similar properties that have recently sold in the area.

- Pros and cons: It’s simple and straightforward, but finding exact matches can be challenging, and market fluctuations can impact valuations.

- Note: While this method is effective for apartments, it can be more difficult to apply to unique properties like single-family homes, which often require a more nuanced approach.

- Income Capitalization Method (Ertragswertverfahren):

- How it works: This method bases the property’s value on its potential rental income. Future income is discounted to present value.

- Pros and cons: Ideal for commercial properties, it considers the property’s earning potential. However, it’s sensitive to factors like interest rates and lease terms.

- Why it’s important: I believe this is a critical factor. If the rental income exceeds the mortgage payments and there’s potential for future value appreciation, it’s a compelling investment.

- Cost Approach (Sachwertverfahren):

- How it works: The value is estimated based on the cost of replacing the property, considering factors like land value, construction costs, and depreciation.

- Pros and cons: It’s useful for new or recently renovated properties. However, it can be challenging to apply to older properties that may require significant renovations.

- Note: In both Germany and many other countries, buildings are often designed to last for a century or more. Older properties might require energy-efficient renovations to meet modern standards, which can be a significant cost.

- Hybrid Approach:

- A combination of the above methods is often used to provide a more comprehensive valuation.

Key Factors Influencing Property Value

When evaluating a property, consider the following factors:

- Location: City, neighborhood, transportation, amenities.

- Size: Land area, building size, number of rooms.

- Condition: Age, renovations, overall state.

- Purpose: Residential, commercial, industrial.

- Land type: Residential plot, commercial lot, agricultural.

- Legal restrictions: Zoning laws, building codes.

- Market conditions: Economic cycles, interest rates.

Long-Term Perspective

Many people wonder why they should invest in real estate during economic downturns. Historically, real estate values have tended to appreciate over time, especially when viewed through a long-term lens. Inflation is a natural part of the economic cycle, and real estate can serve as a hedge against inflation.

Conclusion

While it’s tempting to rely on market appraisals, the true value of a property often lies in its potential. By understanding the factors that influence property value and taking a long-term perspective, you can make informed investment decisions.

Remember, the best investment is in yourself. Continuously educate yourself about the market and don’t hesitate to consult with professionals.

댓글 남기기