Moving to a new country, especially one with a robust social safety net like Germany, can be both exciting and overwhelming. One of the first things on your to-do list is likely to be sorting out your insurance. But with a plethora of options and complex regulations, it can be difficult to know where to start. That’s where an insurance broker comes in.

Understanding Insurance Brokers in Germany

In Germany, insurance brokers play a crucial role in helping individuals and businesses navigate the complex world of insurance. Unlike insurance agents who represent a single company, brokers are independent advisors who work on behalf of their clients. They have access to a wide range of insurance products from multiple providers, allowing them to tailor a policy to your specific needs.

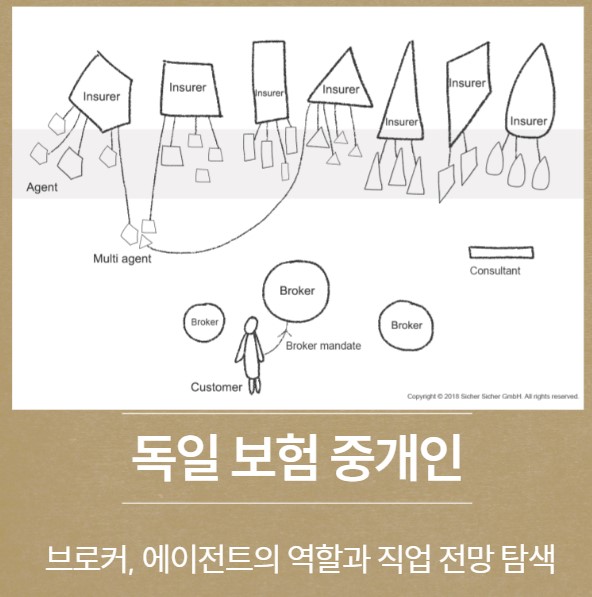

Types of Insurance Intermediaries in Germany

- Agent (Versicherungsvertreter): Represents a single insurance company and is primarily focused on selling their products.

- Multi-agent (Mehrfachvertreter): Represents multiple insurance companies but still has limited options compared to a broker.

- Insurance Consultant (Versicherungsberater): Provides advice but cannot sell policies directly.

- Insurance Broker (Versicherungsmakler): Represents the client’s interests and has access to the entire market.

Why Choose an Insurance Broker?

- Independence: Brokers are not tied to any specific insurance company, ensuring unbiased advice.

- Expertise: They have in-depth knowledge of the German insurance market and can help you understand complex terms and conditions.

- Customization: Brokers can tailor a policy to your exact needs, whether you’re a student, expat, or small business owner.

- Claims Support: In the event of a claim, a broker can assist you in navigating the process.

Key Considerations When Choosing a Broker:

- Credentials: Ensure the broker is licensed by the German Federal Financial Supervisory Authority (BaFin).

- Specialization: Some brokers specialize in specific areas, such as health insurance or commercial insurance.

- Fees: Understand the broker’s fee structure, which can be a percentage of the premium or a flat fee.

- Reputation: Check reviews and ask for references.

Common Types of Insurance in Germany

- Health insurance (Krankenversicherung): Mandatory for all residents.

- Liability insurance (Haftpflichtversicherung): Covers damages caused to others.

- Contents insurance (Hausratversicherung): Protects your belongings.

- Car insurance (Kfz-Versicherung): Required for all vehicle owners.

Navigating the German Insurance Landscape

While the process of finding the right insurance can be daunting, having a qualified insurance broker by your side can make it significantly easier. By understanding the different types of insurance intermediaries and considering the factors outlined above, you can make an informed decision and ensure you have the coverage you need.

Please contact me for finding German Broker. Will free consult by Moraum.

댓글 남기기